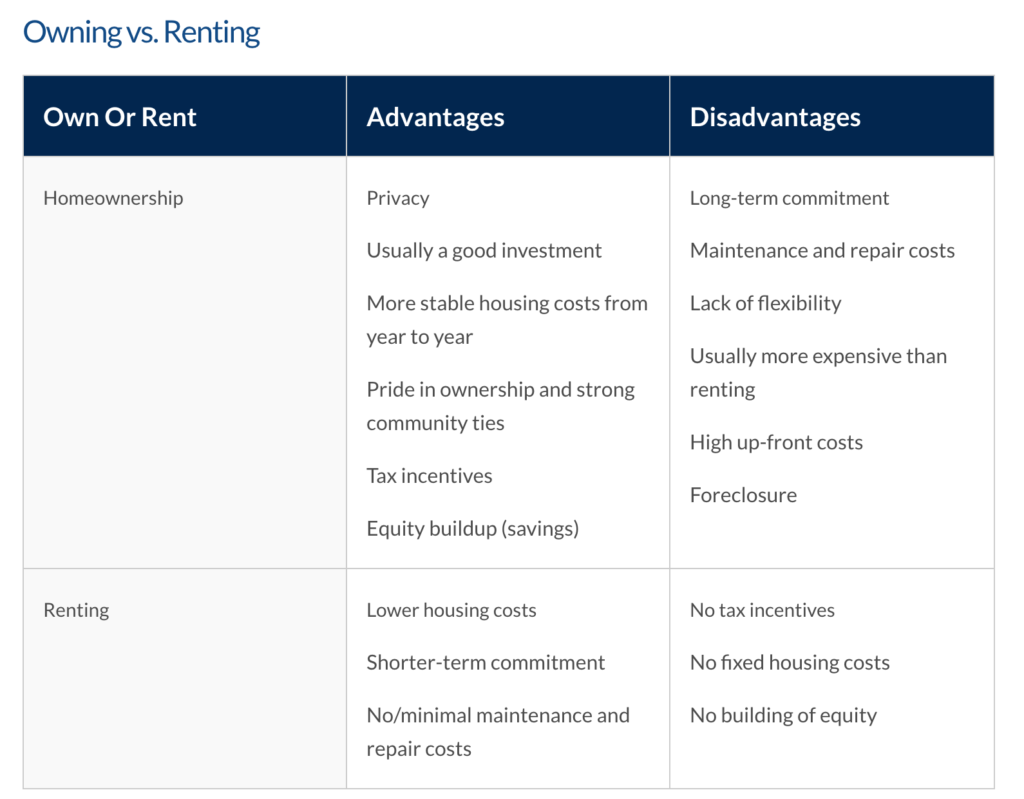

Homeownership comes with several benefits that make it a desirable option for many people, especially those looking for stability, long-term investment, and the pride of owning property. Here are some of the key advantages of owning a home:

-

Greater Privacy: When you own a home, you generally have more privacy than renters. You are not subject to the rules and regulations that landlords may impose, and you don’t have to worry about noisy neighbors or shared spaces like in an apartment complex. You control your environment, whether it’s the layout, the design, or the landscaping.

-

Build Equity and Value: One of the most significant financial advantages of owning a home is the potential for the property to increase in value over time. As you pay down your mortgage, you build equity, which can be a valuable asset. Over the years, the value of your home may appreciate, further increasing your wealth. This is something renters miss out on, as their monthly rent payments contribute to their landlord’s equity, not their own.

-

Predictable Costs: Homeownership, especially when you have a fixed-rate mortgage, provides predictability and stability in your financial situation. Your mortgage payments remain the same each month, which makes it easier to budget for the long term. In contrast, renting can involve rent increases every year, making it harder to plan for the future.

-

Tax Deductions: Owning a home allows you to take advantage of tax benefits. You can deduct mortgage interest and property taxes from your income taxes, which can result in significant savings. This is not something renters can benefit from, as they are not paying property taxes or mortgage interest.

-

Pride of Ownership: There is a sense of pride that comes with owning a home. It’s a place that’s truly yours, where you can make decisions about the design, landscaping, and upgrades. This sense of ownership also ties you more closely to your community, as you’re more likely to invest in maintaining your property and being involved in local affairs.

- Affordable Options: While homeownership may seem out of reach for some, there are affordable options available. For example, lower-cost manufactured homes can provide a more budget-friendly entry into homeownership. By doing research and understanding your financial situation, you can find ways to own a home without breaking the bank.

Advantages and Disadvantages of Renting a Home

Renting a home is another viable option, especially for those who are not ready for the long-term commitment of owning a property or who need more flexibility. Here are the advantages and disadvantages of renting:

Advantages of Renting:

-

Lower Upfront Costs: Renting typically requires a smaller upfront investment compared to buying a home. Renters usually only need to pay a security deposit and their first month’s rent, whereas homebuyers must cover a down payment, closing costs, and possibly other fees.

-

Flexibility: Renting gives you more flexibility, particularly if your job or lifestyle requires frequent moves. Most rental leases are for 12 months, and at the end of the lease term, you have the option to move without the hassle of selling a property or dealing with a long-term commitment.

-

Less Responsibility for Maintenance: One of the most attractive features of renting is that the landlord is typically responsible for the maintenance and repair of the property. Renters are not burdened with the costs or efforts of keeping the property in good condition, whether it’s fixing a broken appliance or maintaining the landscaping.

Disadvantages of Renting:

-

No Tax Benefits: Unlike homeowners, renters do not benefit from tax deductions for mortgage interest and property taxes. This is a significant financial disadvantage, especially for long-term renters who could have built equity if they owned a home.

-

Unpredictable Costs: Renters face the risk of rent increases, which can occur annually or at the end of a lease term. Unlike homeowners with fixed-rate mortgages, renters cannot predict how much they will pay each year, making it harder to plan for the future.

-

No Equity Building: Renting does not build equity or contribute to the ownership of an asset. Renters make payments to their landlords, but those payments do not result in any financial gain for the renter in the long run.

Factors to Consider When Comparing Buying to Renting a Home

When deciding whether to buy or rent, there are several important factors to consider:

-

Homeownership Is Not for Everyone: While homeownership offers many benefits, it’s not suitable for everyone. Renting may be a better option for those who prefer flexibility or who don’t have the financial stability to purchase a home.

-

Income Stability: Homeownership requires a stable or growing income. Without a consistent income, it may be difficult to afford the costs associated with owning a home, including the mortgage, property taxes, insurance, and maintenance.

-

Long-Term Financial Commitment: The financial benefits of owning a home are long-term. Homeownership isn’t a quick way to build wealth, and it requires careful planning, saving, and budgeting. Before buying, it’s important to have a clear financial plan in place.

- Credit Score and Debt: Your credit score plays a crucial role in determining your mortgage eligibility and interest rates. If you have substantial debt, it may be wise to address that first by seeking assistance from a credit counseling agency and paying down debt before applying for a mortgage.

Next Steps

If you’re considering homeownership, the first step is to educate yourself. Taking an online homebuyer education course can help you better understand the home buying process, including financing options, how to save for a down payment, and how to budget for long-term homeownership.

By making informed decisions and understanding both the advantages and responsibilities of homeownership, you can ensure that you are prepared for the next big step in your life. Whether you decide to buy or rent, it’s essential to consider your financial situation, lifestyle, and long-term goals before making a decision.

Adi Zilberberg – Miami Luxury Real Estate Expert